Finally Exposed: Eight Ways the System Has Been Overcharging You - Smart Women Are Fighting Back Before December Deadline

"After 25 years of paying bills and managing household finances, I finally discovered why everything felt so expensive. It wasn't inflation - it was systematic overcharging. Once I knew what to look for, I saved over $3,000 in the first year alone." - Sarah M., 52, Tampa

If you're tired of feeling like you're working harder but getting ahead slower, you're not imagining things. The "Big Beautiful Bill" signed July 4, 2025, has exposed eight specific ways companies have been systematically overcharging families - and more importantly, how to stop it.

Here's what they don't want you to know: Corporate lobbyists are working overtime to shut down these money-saving opportunities by December 2025. The women who act now could save thousands before these loopholes close forever.

DISCOVERY #1: Why Your Car Insurance Keeps Going Up (Even With No Claims)

You've been a loyal customer for years. You pay on time, never file claims, yet your rates keep climbing. Turns out, that loyalty has been costing you an average of $483 annually - what insurance companies quietly call their "loyalty tax."

Here's how they've been playing you: The longer you stay with the same company, the more they charge you. They know you're busy juggling work, family, and everything else - so they count on you not shopping around. Meanwhile, they're offering better rates to new customers using your overpayments to subsidize the deals.

"I was paying $2,100 a year for the same Toyota I'd had for five years. When I finally compared rates, I found the exact same coverage for $597. I felt like such a fool - but then I got angry. How many other women are they doing this to?" - Jennifer K., 48, Orlando

They're trying to shut this down: Insurance companies are lobbying hard to ban the comparison tools that expose their overcharging. Once they succeed, we'll be back to the old system of calling around for quotes - exactly what they're counting on you being too busy to do.

DISCOVERY #2: The Credit Card Interest Rate Cap That Could Save You $1,127 This Year

Let's be honest - between kids' expenses, aging parents, and everything else life throws at you, sometimes the credit cards get used more than you'd like. The good news? Starting in 2026, credit card companies can't charge you more than 20% interest (versus the 27-29% they're charging now).

Here's what this means for your wallet: If you're carrying the typical $6,000 balance, you'll save about $90-120 every month. That's $1,127 back in your pocket every year - money you can put toward your retirement, your kids' college, or just breathing room in your budget.

"For the first time in years, I can see light at the end of the tunnel with my credit card debt. That extra $100 a month is going straight to my emergency fund - something I never thought I'd be able to build." - Lisa R., 45, Jacksonville

DISCOVERY #3: How Home Insurance Companies Have Been Coordinating to Overcharge You

This one will make you furious: Remember how you used to call around for the best home insurance rates, only to find they were all suspiciously similar? Turns out, that wasn't a coincidence. Major insurers have been coordinating their pricing, and you've been paying 23-31% more than you should.

The new comparison tools are finally forcing real competition. Women who've switched are saving an average of $382 annually - that's a nice vacation fund or several months of groceries. Money that was quietly being extracted from your household budget year after year.

⚠️ SMART SHOPPER ALERT: Take your time reviewing any insurance offers. Read all fine print carefully - some comparison sites get paid by certain companies, which could influence what they show you first. Trust your instincts and verify everything independently before switching policies.

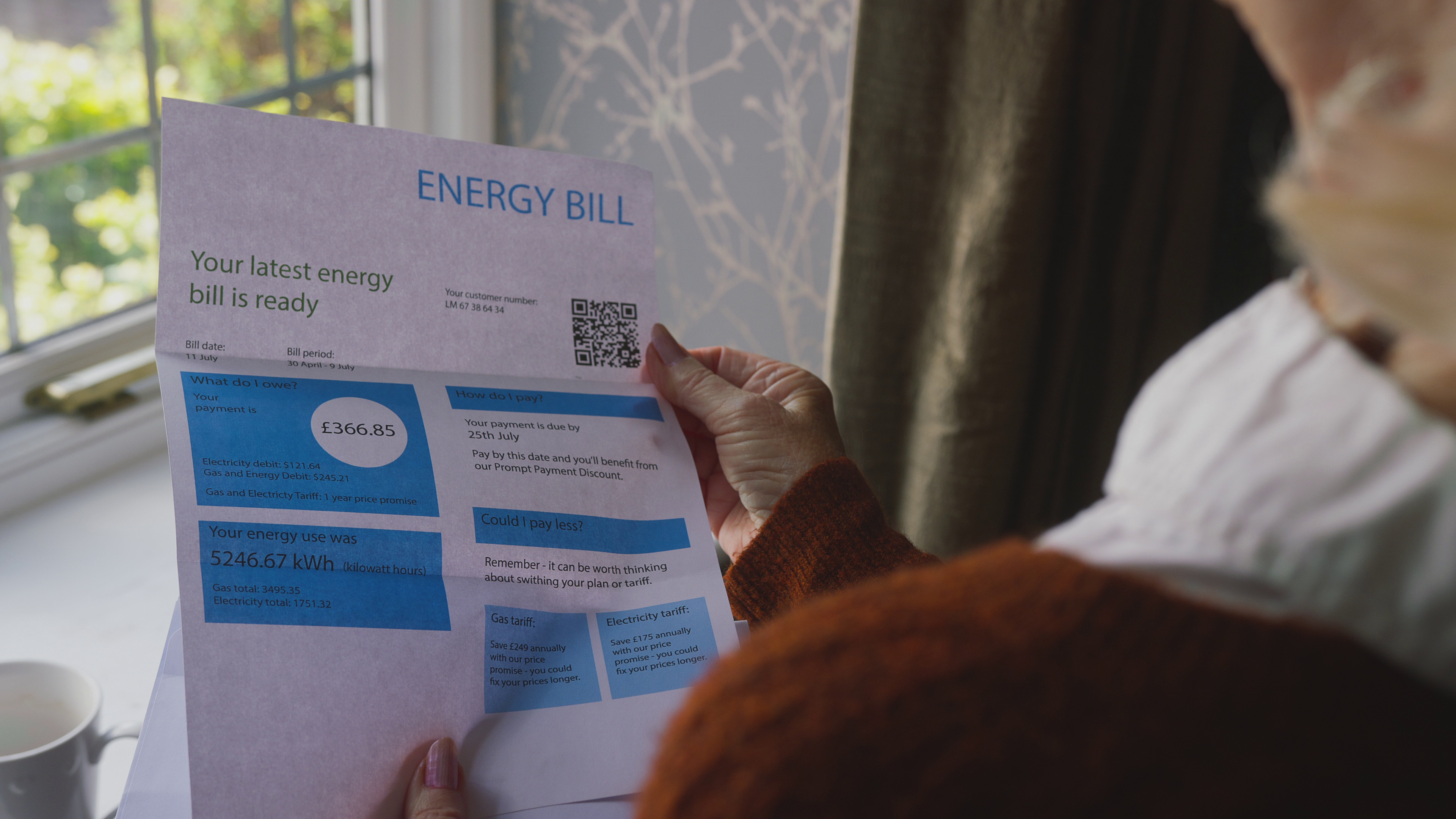

DISCOVERY #4: Get Up to $14,000 Cash Back for Making Your Home More Energy Efficient

Your energy bills keep climbing, but here's something most people don't know: The government is offering up to $14,000 in instant cash back for energy-efficient upgrades. Not tax credits you have to wait for - actual money back at the time of purchase.

This isn't like those complicated rebate programs where you fill out forms and wait months. When you buy qualifying appliances or make energy improvements, the money comes off your bill immediately. It's like getting a discount that pays you back for years through lower energy costs.

DISCOVERY #5: How Medicare Pays for Luxury Bathroom Upgrades (If You Know the Secret)

If you're caring for aging parents (or thinking ahead for yourself), this could save you thousands. Medicare now classifies walk-in tubs as medical equipment, which means they'll pay for most of it. Combined with manufacturer rebates, families are getting $15,000 bathroom systems for under $500.

"My mom needed something safer than her old bathtub, but I thought we'd have to pay thousands out of pocket. Medicare covered $9,000, the manufacturer gave us $3,000 off, and we paid $300 total. It's like they wanted to help us." - Patricia S., 54, Miami

This program ends December 15th because too many people found out about it. If you or a family member could benefit from a safer bathroom setup, don't wait.

DISCOVERY #6: The Burial Insurance Trick That Could Save You $1,000+ Per Year

Nobody likes thinking about this stuff, but if you're responsible for planning ahead (for yourself or your parents), you need to know about this scam. Burial insurance companies charge anywhere from $9 to $97 monthly for identical coverage, depending on which application you fill out.

It's all about knowing which health questions to answer first. The same company, same coverage, but they put you in different "rate classes" based on how you apply. Smart women are locking in the $9 rate before this loophole gets closed.

"My sister and I both got burial insurance from the same company in the same month. She's paying $97, I'm paying $9. Same coverage, same health. The only difference was I knew which questions to answer first." - Carol D., 59, Tampa

DISCOVERY #7: Free Window Replacement Program (But Only If You Were Born Before 1965)

Here's something that will surprise you: There's a government program that will replace your windows for free, but only if you were born before 1965. They're specifically targeting homeowners in our age group because we're the ones who own homes that need these upgrades most.

Only 3% of eligible homeowners even know about this program, despite the government setting aside $2.3 billion for it. They're counting on most of us being too busy to find out about it - but now you know.

DISCOVERY #8: Get $500 Cash for Home Repairs (No Questions Asked)

This one's almost too good to be true: The government is giving homeowners $500 cash for home repairs with barely any paperwork. It's part of an "emergency home repair" program that's flying under the radar.

They're going to shut this down soon because not enough people are supposed to know about it. Right now, less than 5% of eligible homeowners have claimed their $500. Once word gets out, the program will disappear.

THE BOTTOM LINE

For too long, companies have been counting on us being too busy, too trusting, or too overwhelmed to fight back against their overcharging schemes. The "Big Beautiful Bill" has finally exposed these tactics and given us the tools to stop them.

But this window won't stay open forever. Corporate lobbyists are working around the clock to shut down these money-saving opportunities by December 2025. The women who take action now could save thousands before these loopholes disappear.

You've spent years taking care of everyone else. It's time to take care of yourself. Don't let them keep overcharging you when you finally have the power to stop it.